一家著名的AI技术公司正在为IPO提供冲刺:它计划使用约30%的资金来加强研发和技术基础设施!该公司在三年半内损失了超过7亿元人民币

2025-09-18 08:37

2025-09-18 08:39

资料来源:太阳 - 经济新闻

一家著名的AI技术公司正在为IPO提供冲刺:它计划使用约30%的资金来加强研发和技术基础设施!该公司在三年半内损失了超过7亿元人民币

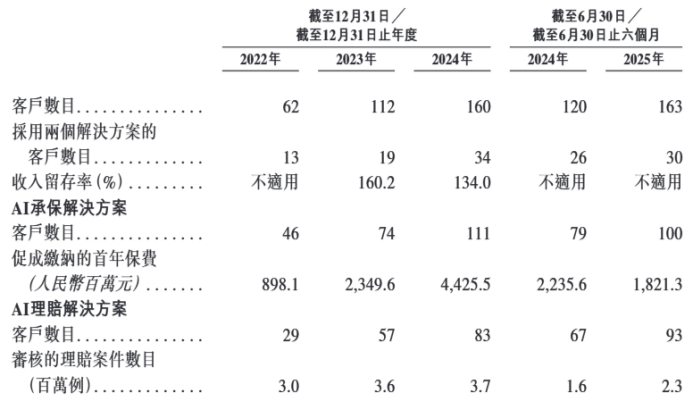

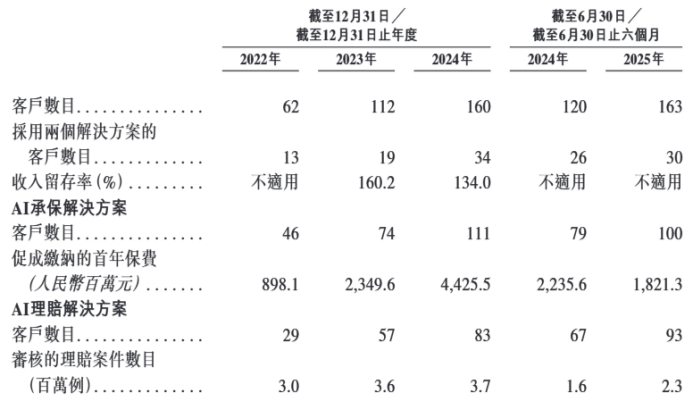

Meike记者| Cai ding Meike的编辑| Duan Lian Wei Guanhong于9月16日,Nuanwa Insight Technology Co,Ltd(从那里称为“ Nanwa”),在香港证券交易所的独立AI(人工智能)文件),与JPMORGAN CHASE和HSBC一起在香港证券交易所。 Nuanwa的招股说明书计划使用近30%的资金来加强研发和技术基础设施;约30%扩大公司地理的范围,不同促进和增强产品;大约30%的与保险技术有关的企业的战略投资;大约有10%的公司运营资本和公司的其他一般目的。 “日常经济新闻”的记者跟随招股说明书,发现Nauna和Zhongan Online的业务有着深厚的联系。从2022年到2024年,以及2025年上半年,方甘在线不仅是Nuanwa最大的客户,而且是其供应商之一。其收入的几乎75%来自“ AI承保解决方案”。 Nuanwa是保险行业的AI技术公司。招股说明书援引弗罗斯特(Frost)和沙利文(Sullivan)的报告指出,根据2024年处理的保险案例数量,Nauna是中国保险业最大的独立AI技术公司。 Nuanwa表示,可以通过模块化套件来访问该公司的解决方案,这些套件可访问云基础架构,并可以通过应用程序界面或API Laye轻松提供客户r。 Hanggang sa Disyembre 31, 2024, ang solusyon ng Nuanwa ay pinagtibay ng 90 mga kumpanya ng seguro, kasama ang 8 sa nangungunang sampung kumpanya ng seguro sa China batay sa premium na kita noong 2024. Hanggang sa Hunyo 30, 2025, ang Nuanwa ay Nagpatupad ng isang kabuuang 204.3 Milyong在Mga Kaso ng Pagsisiyasat上承销Na Pagsusuri,在Nagsilbi Ng Higit Sa 41 Milyong在Inaangkin Kang Mga Ang Mga Mga Cultans Ng Mga Mga Kumpanya ng保险中承销。从建立到2025年6月30日,Nuanwayi在第一年的保费中贡献了总计107亿元人民币的贡献。 Nuanwa提供了两种以保险为中心的解决方案,尤其是AI承保解决方案和AI索赔解决方案。此外,到2024年底,Nauwa与7家主要保险公司合作,为患者推出了14种保险产品,涵盖了21种适应症和9种创新疗法。该招股说明书表明,从2022年到2024年和2025年上半年(从其中作为“报告期”),Nuanwa'S收入主要来自AI承保解决方案,收入分别为62.5%,70.6%,77.6%和74.5%。在报告期间,AI承保解决方案的毛利率分别为69.1%,66.3%,53.3%和56.7%。 The reporter noticed that during the reporting period, the customers of NuanwaangAs is 62, 112, 160 and 163 respectively, showing an increase in trend.资料来源:Nuanwa招股说明书Zhongan Online是最大的单一客户,也是公司的供应商之一。 In terms of financial aspects, during the reporting, Nuanwa achieved the income of 345 million yuan, 655 million yuan, 944 million yuan and 431 million yuan respectively.同时,该公司的损失分别为2.23亿元,2.4亿元,1.55亿元和9987.7万元。换句话说,在报告中,努瓦(Nuanwa)消失了约7.18亿元。招股说明书表明,Nuanwa客户是中国主要的保险公司。在t期间他报告说,该公司从前五位客户的收入同时占收入的92.3%,82.9%,78.9%和73.6%。同时,该公司的最佳单身客户收入分别为78.7%,61.8%,45.2%和49.6%的收入。 It can be seen that even though the customer's concentration at Nuanwa during the reporting decreases, there is still a problem of high concentration.努瓦(Nuanwa)向招股说明书清楚地提到,“最大的单一客户”是股东之一的中国在线。 In response, Nuanwa said: "Since our main business is closely connected to the Zhongan online insurance business in many levels, our business is highly aid in the Zhongan Online business and can bring benefits to each other ..." The reporter of the "sunny economic news" not only noted that Zhongan online is not only the biggest customer of the Nuanwa, but also its suppliers.招股说明书指出:“在线和/或其联系人为我们提供了许多服务满足我们的综合性和运营需求。 “至于为什么他们选择同事作为供应商之一,努瓦说这是因为“更有效”。 Specifically, during the reporting, the NAWWA pays the value of the Zhongan Online transaction for specific services is RMB 12.31 million, RMB 5.38 million, RMB 3.92 million and RMB 1.15 million respectively. In addition to the high concentration of the Zhongan online participation online in the establishment of a company, the short -term pressure of the Nuanwa debt repayment has intensified. In particular, the prospectus shows that during the reporting period, the total current ownership of NUNAWA is RMB 412 million, RMB 488 million, RMB 658 million and RMB 651 million, respectively, and the company's total current responsibility at the same time is RMB 942 million, RMB 1.267 billion 1.696 billion billion.历史Nnuanwa可以追溯到2018年10月成立的Nuanwa Wuxi,由Lu Min和Zhongan创立和统治在线的。招股说明书表明,现年50岁的Lu Min是Nuanwa的创始人,执行董事,董事长兼首席执行官。 Lu Min在保险技术行业拥有20多年的经验。 He won a bachelor's degree in computer applications from Shanghai Maritime University in July 1996. He also worked at Jiangnan University in China in the early days. He later served as vice president of the Business operation of Yibao Network Technology (Shanghai) Co, Ltd., a multinational insurance software provider, and a member of the Shanghai Insurance Exchange Executive Committee and General Manager of the Insurance Technology Division. Since its founding, Nuanwa has experienced four financing cycles and has introduced many well-known institutions such as SequoiaCapital and longfor. The reporter of the day -to -day -economic "was noted that on the date of disclosure of the prospectus, Zhongan OnlineMay -it was a 31.65% interest in the company through a controlled corporation (such as the Zhongan信息技术子公司,ZA技术等)。中国在线和肩膀支付付款,《每日经济新闻》的记者NBDNews原始文章

(收费编辑:CAI Qing)

Net's Statement to China: The Information on StocK market is from the media cooperative and institutions, and the personal opinion of the set and only for the reference of investors and not developing investment advice.投资者在此基础上以自己的风险行事。

2479749

一家著名的AI技术公司正在为IPO提供冲刺:它计划使用约30%的资金来加强研发和技术基础设施!该公司在三年半内损失了超过7亿元人民币

220084

保险新闻新闻

太阳经济新闻

2025-09-18

一家著名的AI技术公司正在为IPO提供冲刺:它计划使用约30%的资金来加强研发和技术基础设施!该公司在三年半内损失了超过7亿元人民币

2025-09-18 08:37

2025-09-18 08:39

资料来源:太阳 - 经济新闻

一家著名的AI技术公司正在为IPO提供冲刺:它计划使用约30%的资金来加强研发和技术基础设施!该公司在三年半内损失了超过7亿元人民币

Meike记者| Cai ding Meike的编辑| Duan Lian Wei Guanhong于9月16日,Nuanwa Insight Technology Co,Ltd(从那里称为“ Nanwa”),在香港证券交易所的独立AI(人工智能)文件),与JPMORGAN CHASE和HSBC一起在香港证券交易所。 Nuanwa的招股说明书计划使用近30%的资金来加强研发和技术基础设施;约30%扩大公司地理的范围,不同促进和增强产品;大约30%的与保险技术有关的企业的战略投资;大约有10%的公司运营资本和公司的其他一般目的。 “日常经济新闻”的记者跟随招股说明书,发现Nauna和Zhongan Online的业务有着深厚的联系。从2022年到2024年,以及2025年上半年,方甘在线不仅是Nuanwa最大的客户,而且是其供应商之一。其收入的几乎75%来自“ AI承保解决方案”。 Nuanwa是保险行业的AI技术公司。招股说明书援引弗罗斯特(Frost)和沙利文(Sullivan)的报告指出,根据2024年处理的保险案例数量,Nauna是中国保险业最大的独立AI技术公司。 Nuanwa表示,可以通过模块化套件来访问该公司的解决方案,这些套件可访问云基础架构,并可以通过应用程序界面或API Laye轻松提供客户r。 Hanggang sa Disyembre 31, 2024, ang solusyon ng Nuanwa ay pinagtibay ng 90 mga kumpanya ng seguro, kasama ang 8 sa nangungunang sampung kumpanya ng seguro sa China batay sa premium na kita noong 2024. Hanggang sa Hunyo 30, 2025, ang Nuanwa ay Nagpatupad ng isang kabuuang 204.3 Milyong在Mga Kaso ng Pagsisiyasat上承销Na Pagsusuri,在Nagsilbi Ng Higit Sa 41 Milyong在Inaangkin Kang Mga Ang Mga Mga Cultans Ng Mga Mga Kumpanya ng保险中承销。从建立到2025年6月30日,Nuanwayi在第一年的保费中贡献了总计107亿元人民币的贡献。 Nuanwa提供了两种以保险为中心的解决方案,尤其是AI承保解决方案和AI索赔解决方案。此外,到2024年底,Nauwa与7家主要保险公司合作,为患者推出了14种保险产品,涵盖了21种适应症和9种创新疗法。该招股说明书表明,从2022年到2024年和2025年上半年(从其中作为“报告期”),Nuanwa'S收入主要来自AI承保解决方案,收入分别为62.5%,70.6%,77.6%和74.5%。在报告期间,AI承保解决方案的毛利率分别为69.1%,66.3%,53.3%和56.7%。 The reporter noticed that during the reporting period, the customers of NuanwaangAs is 62, 112, 160 and 163 respectively, showing an increase in trend.资料来源:Nuanwa招股说明书Zhongan Online是最大的单一客户,也是公司的供应商之一。 In terms of financial aspects, during the reporting, Nuanwa achieved the income of 345 million yuan, 655 million yuan, 944 million yuan and 431 million yuan respectively.同时,该公司的损失分别为2.23亿元,2.4亿元,1.55亿元和9987.7万元。换句话说,在报告中,努瓦(Nuanwa)消失了约7.18亿元。招股说明书表明,Nuanwa客户是中国主要的保险公司。在t期间他报告说,该公司从前五位客户的收入同时占收入的92.3%,82.9%,78.9%和73.6%。同时,该公司的最佳单身客户收入分别为78.7%,61.8%,45.2%和49.6%的收入。 It can be seen that even though the customer's concentration at Nuanwa during the reporting decreases, there is still a problem of high concentration.努瓦(Nuanwa)向招股说明书清楚地提到,“最大的单一客户”是股东之一的中国在线。 In response, Nuanwa said: "Since our main business is closely connected to the Zhongan online insurance business in many levels, our business is highly aid in the Zhongan Online business and can bring benefits to each other ..." The reporter of the "sunny economic news" not only noted that Zhongan online is not only the biggest customer of the Nuanwa, but also its suppliers.招股说明书指出:“在线和/或其联系人为我们提供了许多服务满足我们的综合性和运营需求。 “至于为什么他们选择同事作为供应商之一,努瓦说这是因为“更有效”。 Specifically, during the reporting, the NAWWA pays the value of the Zhongan Online transaction for specific services is RMB 12.31 million, RMB 5.38 million, RMB 3.92 million and RMB 1.15 million respectively. In addition to the high concentration of the Zhongan online participation online in the establishment of a company, the short -term pressure of the Nuanwa debt repayment has intensified. In particular, the prospectus shows that during the reporting period, the total current ownership of NUNAWA is RMB 412 million, RMB 488 million, RMB 658 million and RMB 651 million, respectively, and the company's total current responsibility at the same time is RMB 942 million, RMB 1.267 billion 1.696 billion billion.历史Nnuanwa可以追溯到2018年10月成立的Nuanwa Wuxi,由Lu Min和Zhongan创立和统治在线的。招股说明书表明,现年50岁的Lu Min是Nuanwa的创始人,执行董事,董事长兼首席执行官。 Lu Min在保险技术行业拥有20多年的经验。 He won a bachelor's degree in computer applications from Shanghai Maritime University in July 1996. He also worked at Jiangnan University in China in the early days. He later served as vice president of the Business operation of Yibao Network Technology (Shanghai) Co, Ltd., a multinational insurance software provider, and a member of the Shanghai Insurance Exchange Executive Committee and General Manager of the Insurance Technology Division. Since its founding, Nuanwa has experienced four financing cycles and has introduced many well-known institutions such as SequoiaCapital and longfor. The reporter of the day -to -day -economic "was noted that on the date of disclosure of the prospectus, Zhongan OnlineMay -it was a 31.65% interest in the company through a controlled corporation (such as the Zhongan信息技术子公司,ZA技术等)。中国在线和肩膀支付付款,《每日经济新闻》的记者NBDNews原始文章

(收费编辑:CAI Qing)

Net's Statement to China: The Information on StocK market is from the media cooperative and institutions, and the personal opinion of the set and only for the reference of investors and not developing investment advice.投资者在此基础上以自己的风险行事。

2479749

一家著名的AI技术公司正在为IPO提供冲刺:它计划使用约30%的资金来加强研发和技术基础设施!该公司在三年半内损失了超过7亿元人民币

220084

保险新闻新闻

太阳经济新闻

2025-09-18

一家著名的AI技术公司正在为IPO提供冲刺:它计划使用约30%的资金来加强研发和技术基础设施!该公司在三年半内损失了超过7亿元人民币

2025-09-18 08:37

2025-09-18 08:39

资料来源:太阳 - 经济新闻

一家著名的AI技术公司正在为IPO提供冲刺:它计划使用约30%的资金来加强研发和技术基础设施!该公司在三年半内损失了超过7亿元人民币

Meike记者| Cai ding Meike的编辑| Duan Lian Wei Guanhong于9月16日,Nuanwa Insight Technology Co,Ltd(从那里称为“ Nanwa”),在香港证券交易所的独立AI(人工智能)文件),与JPMORGAN CHASE和HSBC一起在香港证券交易所。 Nuanwa的招股说明书计划使用近30%的资金来加强研发和技术基础设施;约30%扩大公司地理的范围,不同促进和增强产品;大约30%的与保险技术有关的企业的战略投资;大约有10%的公司运营资本和公司的其他一般目的。 “日常经济新闻”的记者跟随招股说明书,发现Nauna和Zhongan Online的业务有着深厚的联系。从2022年到2024年,以及2025年上半年,方甘在线不仅是Nuanwa最大的客户,而且是其供应商之一。其收入的几乎75%来自“ AI承保解决方案”。 Nuanwa是保险行业的AI技术公司。招股说明书援引弗罗斯特(Frost)和沙利文(Sullivan)的报告指出,根据2024年处理的保险案例数量,Nauna是中国保险业最大的独立AI技术公司。 Nuanwa表示,可以通过模块化套件来访问该公司的解决方案,这些套件可访问云基础架构,并可以通过应用程序界面或API Laye轻松提供客户r。 Hanggang sa Disyembre 31, 2024, ang solusyon ng Nuanwa ay pinagtibay ng 90 mga kumpanya ng seguro, kasama ang 8 sa nangungunang sampung kumpanya ng seguro sa China batay sa premium na kita noong 2024. Hanggang sa Hunyo 30, 2025, ang Nuanwa ay Nagpatupad ng isang kabuuang 204.3 Milyong在Mga Kaso ng Pagsisiyasat上承销Na Pagsusuri,在Nagsilbi Ng Higit Sa 41 Milyong在Inaangkin Kang Mga Ang Mga Mga Cultans Ng Mga Mga Kumpanya ng保险中承销。从建立到2025年6月30日,Nuanwayi在第一年的保费中贡献了总计107亿元人民币的贡献。 Nuanwa提供了两种以保险为中心的解决方案,尤其是AI承保解决方案和AI索赔解决方案。此外,到2024年底,Nauwa与7家主要保险公司合作,为患者推出了14种保险产品,涵盖了21种适应症和9种创新疗法。该招股说明书表明,从2022年到2024年和2025年上半年(从其中作为“报告期”),Nuanwa'S收入主要来自AI承保解决方案,收入分别为62.5%,70.6%,77.6%和74.5%。在报告期间,AI承保解决方案的毛利率分别为69.1%,66.3%,53.3%和56.7%。 The reporter noticed that during the reporting period, the customers of NuanwaangAs is 62, 112, 160 and 163 respectively, showing an increase in trend.资料来源:Nuanwa招股说明书Zhongan Online是最大的单一客户,也是公司的供应商之一。 In terms of financial aspects, during the reporting, Nuanwa achieved the income of 345 million yuan, 655 million yuan, 944 million yuan and 431 million yuan respectively.同时,该公司的损失分别为2.23亿元,2.4亿元,1.55亿元和9987.7万元。换句话说,在报告中,努瓦(Nuanwa)消失了约7.18亿元。招股说明书表明,Nuanwa客户是中国主要的保险公司。在t期间他报告说,该公司从前五位客户的收入同时占收入的92.3%,82.9%,78.9%和73.6%。同时,该公司的最佳单身客户收入分别为78.7%,61.8%,45.2%和49.6%的收入。 It can be seen that even though the customer's concentration at Nuanwa during the reporting decreases, there is still a problem of high concentration.努瓦(Nuanwa)向招股说明书清楚地提到,“最大的单一客户”是股东之一的中国在线。 In response, Nuanwa said: "Since our main business is closely connected to the Zhongan online insurance business in many levels, our business is highly aid in the Zhongan Online business and can bring benefits to each other ..." The reporter of the "sunny economic news" not only noted that Zhongan online is not only the biggest customer of the Nuanwa, but also its suppliers.招股说明书指出:“在线和/或其联系人为我们提供了许多服务满足我们的综合性和运营需求。 “至于为什么他们选择同事作为供应商之一,努瓦说这是因为“更有效”。 Specifically, during the reporting, the NAWWA pays the value of the Zhongan Online transaction for specific services is RMB 12.31 million, RMB 5.38 million, RMB 3.92 million and RMB 1.15 million respectively. In addition to the high concentration of the Zhongan online participation online in the establishment of a company, the short -term pressure of the Nuanwa debt repayment has intensified. In particular, the prospectus shows that during the reporting period, the total current ownership of NUNAWA is RMB 412 million, RMB 488 million, RMB 658 million and RMB 651 million, respectively, and the company's total current responsibility at the same time is RMB 942 million, RMB 1.267 billion 1.696 billion billion.历史Nnuanwa可以追溯到2018年10月成立的Nuanwa Wuxi,由Lu Min和Zhongan创立和统治在线的。招股说明书表明,现年50岁的Lu Min是Nuanwa的创始人,执行董事,董事长兼首席执行官。 Lu Min在保险技术行业拥有20多年的经验。 He won a bachelor's degree in computer applications from Shanghai Maritime University in July 1996. He also worked at Jiangnan University in China in the early days. He later served as vice president of the Business operation of Yibao Network Technology (Shanghai) Co, Ltd., a multinational insurance software provider, and a member of the Shanghai Insurance Exchange Executive Committee and General Manager of the Insurance Technology Division. Since its founding, Nuanwa has experienced four financing cycles and has introduced many well-known institutions such as SequoiaCapital and longfor. The reporter of the day -to -day -economic "was noted that on the date of disclosure of the prospectus, Zhongan OnlineMay -it was a 31.65% interest in the company through a controlled corporation (such as the Zhongan信息技术子公司,ZA技术等)。中国在线和肩膀支付付款,《每日经济新闻》的记者NBDNews原始文章

(收费编辑:CAI Qing)

Net's Statement to China: The Information on StocK market is from the media cooperative and institutions, and the personal opinion of the set and only for the reference of investors and not developing investment advice.投资者在此基础上以自己的风险行事。

2479749

一家著名的AI技术公司正在为IPO提供冲刺:它计划使用约30%的资金来加强研发和技术基础设施!该公司在三年半内损失了超过7亿元人民币

220084

保险新闻新闻

太阳经济新闻

2025-09-18

推荐文章

推荐文章